In depth Analysis of 2025 Electronic Signature Software: Market Demand Interpretation and Strength Evaluation of 17 Mainstream Manufacturers

( The information in this article is sourced from online platforms

1 . Industry Overview and Core Values

1.1 Definition and Development Background of Electronic Signature

The electronic signature system is an electronic document authentication tool based on digital signature technology. It verifies the identity of the signatory through encryption, ensures the authenticity and integrity of the document, and gives electronic documents the same legal effect as traditional paper seals. According to the revised provisions of the Electronic Signature Law of the People's Republic of China, electronic signatures have been clearly recognized as having full legal effect, and their application scenarios have covered various fields such as personnel, procurement, and housing transactions. In terms of technical composition, the electronic signature system consists of four core modules: digital certificate authentication system (provided by CA institutions for identity binding), electronic seal management system (implementing digital lifecycle management of seals), electronic signature authentication system (implementing signature verification based on asymmetric encryption algorithms), and client signature software (providing user interaction interface).

1.2 The core value dimension of electronic signatures

· Cost reduction and efficiency improvement value: After adopting electronic signatures, the contract signing cycle of enterprises has been shortened from the traditional mode of days or even weeks to minutes, and the average signing cost has decreased by more than 60%.. Taking financial institutions as an example, the number of contracts processed through electronic signatures reached 100 million in 2024, and it is expected to save more than 10 billion yuan in paper contract costs by 2025.

· Security and compliance value: Through core technologies such as original sandbox protection, multi timestamp evidence solidification, and blockchain certification, file tampering prevention and full chain traceability of operations are achieved..

· Ecological collaborative value: As a digital infrastructure for enterprises, electronic signatures have been deeply embedded in systems such as OA, ERP, and supply chain management. The integration case of Tencent Electronic Signature with Tencent Meeting and Enterprise WeChat shows that cross departmental collaboration efficiency has been improved by more than 40%.

2 . Analysis of Major Market Participants (Introduction to the Advantages and Highlights of Mainstream Manufacturers)

1、 Contract Lock: a leading manufacturer in the industry, the preferred platform for medium and large enterprises, with over 42000 medium and large customer resources. Since its establishment, it has zero disputes, zero lawsuits, and zero disputes, focusing on providing compliant product services that comply with the requirements of the Electronic Signature Law.

2、 Open Sign: The first open-source and free electronic signature system provider in China, focusing on providing zero cost and highly flexible electronic signature solutions for small and medium-sized enterprises, and lowering usage barriers through open core code.

3、 Sign Shield: A full evidence chain electronic signature service provider, with security and compliance as its core, relying on blockchain and encryption technology to build electronic signature and contract management solutions.

4、 Baiwang Cloud Signature: The electronic signature and electronic seal module under Baiwang Cloud is positioned as the core of compliance signing services in the digital ecosystem of finance and taxation

5、 Yisign: Jointly trust its enterprise level electronic signature platform, relying on the integration of trusted timestamps and digital certificates to achieve reliable electronic signatures, positioning itself as a full scenario contract signing and management service provider.

6、 Fada focuses on electronic signing SaaS cloud platform services, with abundant legal service resources and a focus on the small and medium-sized enterprise market.

7、 Anxin Sign: A product under the FCA team, with "financial grade password technology" as its core, specializing in strong compliance scenarios such as banking/insurance.

8、 Anzhengtong: Dual brand“ Anzhengtong+One Sign Pass” Covering the party and government intranet and cloud services, fully compatible with Xinchuang.

9、 Yiqi Sign: Kingdee ecosystem partner, a vertical solution for ERP financial document electronic signing, covering the entire procurement to payment chain.

10、 Micro Signature: Expert in OA integrated electronic signature, "DingTalk/Enterprise WeChat native embedding", focusing on process automation for small and medium-sized enterprises.

11、 Chapter Manager: The pioneer of the integrated control solution of "physical seal+electronic seal", solving the risk control problem in mixed seal scenarios.

12. Zhixiang Sign : a brand under the state-owned enterprise China Electronics Technology Group Corporation, focusing on human resources electronic sign scenarios, with full stack adaptation capabilities for information and innovation, and serving the needs of domestic substitution.

13, Tencent Electronic Signature : Tencent's C-end ecosystem extension, focusing on fast signing of WeChat mini programs and meeting the lightweight needs of small and micro enterprises and individuals.

14, Hongding Cloud Signature : Regional government service provider, "Government Trusted Cloud Signature" supplier, deeply integrated with provincial and municipal one-stop service platforms.

15, Scholar Electronic Signature : With 20 years of digital signature technology accumulation, the standard setter for "OFD format document signature", and mandatory supporting in the field of official documents.

16, Docusign : A localized version of the global electronic signature giant in China, preferred for "cross-border business signing compliance", supporting legal adaptation to over 150 countries.

17, Hello Sign : We are a technology-based service provider in the international electronic signature market, positioned as an enterprise level signature infrastructure provider, with high integration and developer friendliness as our core advantages.

…

3. Market size and growth drivers

3.1 Market size and user growth

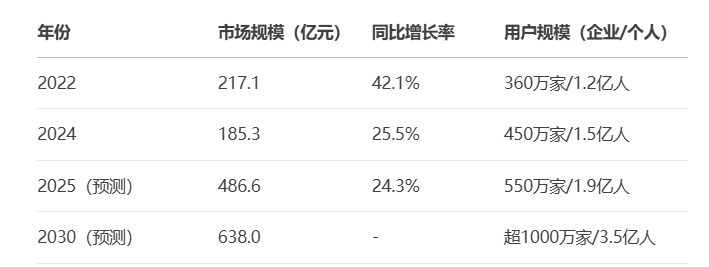

The Chinese electronic signature market is showing explosive growth. The industry scale will reach 21.71 billion yuan in 2022 (a year-on-year increase of 42.1%), increase to 18.53 billion yuan in 2024, and is expected to exceed 48.66 billion yuan in 2025, with a compound annual growth rate (CAGR) of over 25%. Synchronized expansion of user scale: By the end of 2024, the number of enterprise users has exceeded 4.5 million (an annual increase of 25%), the number of individual user registrations has reached 150 million, and the proportion of active users has increased to 50%.

* Table: Forecast of China's Electronic Signature Market Size (2022-2030) *

3. 2. Policy driven and digital transformation needs

① Continuous empowerment of policies and regulations:

· Ministry of Industry and Information Technology; Digital Trust Action Plan; (2024-2027) Invest 10 billion yuan in special funds for the research and development of electronic signature technology and the construction of CA centers, with the goal of building 100 national service outlets by 2025.

· The National Cryptography Administration of China has released the first national level special regulation on electronic seals - the "Regulations on the Administration of Electronic Seals (Draft for Comments)", which further clarifies the "Electronic Seal Management Measures" through unified standards; Electronic Seal” Promote mutual trust and recognition, standardized management, and widespread use of electronic seals nationwide in terms of legal effectiveness, scope of application, and management responsibilities.

· The RCEP agreement has come into effect, promoting cross-border paperless trade and requiring member countries to mutually recognize the effectiveness of electronic signatures, paving the way for Chinese companies to go global.

② Accelerated digital transformation of enterprises: The demand for digitalization in the manufacturing industry is highlighted, and the efficiency of contract signing has become a key indicator of supply chain collaboration. The penetration rate of electronic signatures in the government sector has jumped from 40% in 2023 to 60% in 2024, and is expected to reach 85% by 2025; One Stop Service” The policy promotes 100% integration of electronic signature systems into provincial government platforms.

3.3 Dual drive technology cost

· The SaaS model dominates the market: By 2024, the SaaS model will account for 72% (13.32 billion yuan), making it the mainstream choice in the market due to its flexible deployment and low subscription and payment costs (with an average annual investment of 10000 to 90000 yuan for small and medium-sized enterprises).

· The demand for privatization deployment is growing: Large enterprises, due to data security considerations, have localized deployment solutions accounting for 37%. Currently, the total number of localized deployments of contract lock electronic signatures in the industry ranks first in the industry (according to the Sullivan report).

4 . Technical Architecture and Innovation Trends

4.1 Layered Analysis of Technical Architecture

Modern electronic signature systems adopt a layered decoupling architecture to achieve a balance between security and flexibility:

Basic Layer: composed of CA institutions (such as digital authentication), timestamp service centers, and password modules, providing digital certificate issuance and encryption operation services. In 2024, the issuance of digital certificates in China will exceed 200 million, of which 60% will be used in electronic signature scenarios.

Platform layer: includes three major modules: signature engine, seal management, and permission control, supporting API integration with business systems..

Application Layer: Provides multiple entry points such as SaaS portal, mobile app, mini program, etc. Data shows that 68% of enterprises prefer to use mobile SMS to sign links, and 64.9% use PC platforms, reflecting the necessity of multi terminal adaptation.

4.2 Frontier Technology Fusion Innovation

· Blockchain certification: Blockchain technology provides tamper proof certification capabilities for electronic signatures. The contract hash value can be synchronized to the judicial blockchain, with a judicial acceptance rate of 100%.

· AI smart contract: Combining AI intelligent technology to promote the upgrade of electronic signing services has become a new driving force for the growth of the vendor market. At present, top manufacturers such as Contract Lock and Fada have announced support for AI intelligent technology to achieve full lifecycle management of contract drafting, approval, signing, and archiving.

· The legal review model: numerous electronic signature products with AI intelligent products have seven capabilities including intelligent contract review, risk warning, and clause comparison, compressing the manual review time from hours to seconds.

· Performance automation: NLP technology analyzes key nodes of contracts (such as payment dates), automatically triggers performance reminders, and reduces the default rate of manufacturing customer contracts by 35%.

· Mobility and biometric authentication: By 2024, the proportion of mobile signatures will reach 45%, combined with biometric authentication such as facial recognition and fingerprints to ensure the security of remote signatures.

5 . Application scenario penetration analysis

5.1 Deep penetration in core application areas

Electronic signatures have been upgraded from a single tool to a full chain digital collaborative engine, significantly increasing penetration in three core scenarios:

· Human resources scenario (penetration rate of 65%): covering the entire process of electronic labor contracts, onboarding documents, performance evaluation forms, etc. The fastest growth in usage will be in 2024, as the "Guidelines for the Establishment of Electronic Labor Contracts" promote the comprehensive replacement of paper contracts by enterprises, resulting in an 80% increase in signing efficiency.

· Supply chain collaboration (penetration rate 56.7%): Leading manufacturing companies such as Changan Automobile have connected purchase orders, logistics documents, quality inspection reports, and other links through electronic signatures, reducing the average response time of the supply chain from 7 days to 24 hours.

· Financial services (penetration rate of 40.5%): Bank credit contracts, insurance policies, and securities agreements are fully digitized. In 2024, the electronic channel business of the banking industry will account for 75%, and the use rate of electronic signatures of some Internet banks will reach 100%. 5.2 Rapid Expansion of Emerging Scenarios

· Digitalization of government affairs: By 2024, the electronic signature access rate of the provincial government service network will reach 100%, which will be applied in real estate registration, enterprise establishment, tax declaration and other scenarios.

· Medical and Health: The proportion of electronic medical record signatures will increase from 20% in 2023 to 30% in 2024, addressing the legality issues of prescription circulation and medical insurance settlement.

· Manufacturing industry going global: In response to compliance needs in multiple regions, Contract Lock has built a multi language signing cloud platform that supports standards such as EU eIDAS and US ESIGN, helping multinational corporations and other enterprises reduce overseas contract signing costs by 70%. Table: Top 5 to 6 penetration rates of electronic signature industry applications in 2024 Competition pattern and industrial chain ecology

6.1 Market concentration and layout of top enterprises

China's electronic signature market presents a high concentration pattern, with top 3 manufacturers such as contract locks occupying more than 70% of the market share:

· Contract Lock: Focusing on the government and medium to large customer markets, it has a four in one product system of electronic signatures, digital identities, seal control, and digital archiving, supporting AI intelligent contract management.

· E-Sign Treasure: The most complete product matrix covers public cloud, hybrid cloud, hardware encryption devices, and supports multiple convenient signing methods such as mobile signing, web signing, and app signing.

· Shangshang Sign: Focus on SaaS standardized products, with a large number of small and medium-sized enterprise customers. Launched in 2024; Integration of Contract Management and Storage; Platform, contract management efficiency increased by 50%.

6.2 Collaborative Development of Industrial Chain

The electronic signature industry chain has formed a hierarchical collaborative ecosystem:

Upstream:

CA certification agencies: Digital certification (25% market share) and other enterprises provide digital certificate services, with a market size of 12 billion yuan by 2024.

Encryption hardware vendors: Security chip shipments are expected to increase by 20% annually, reaching 500 million pieces by 2025, and supporting signing methods such as Ukey and Cloud Shield.

.Midstream: Platform service providers strengthen ecological integration, and various manufacturers accelerate the search for upstream and downstream partners in the market to achieve a closed-loop of signing approval archiving.

.Downstream: Industry customized solutions become the focus of competition:

Government affairs field: cross provincial signature mutual recognition (provincial electronic seal platform access)

Manufacturing industry: global compliance signing (supporting multiple languages and jurisdictions)

Medical: joint signature between doctors and patients (binding electronic medical records and love letters)

7 . Development Challenges and Future Trends

7.1 Core Challenge Analysis

· Security and privacy concerns: 73.3% of users are concerned about privacy breaches, and 67.8% question the security of the signing process. Data protection needs to be strengthened through techniques such as Zero Knowledge Proof and homomorphic encryption.

· Insufficient penetration of small and medium-sized enterprises: Due to limited awareness and budget constraints, the penetration rate of electronic signatures in small and medium-sized enterprises is less than 30%. Lightweight SaaS tools (such as Tencent Electronic Signature Mini Program Edition) need to be provided to lower the usage threshold.

· Cross border mutual recognition barriers: Different countries have different electronic signature standards (such as EU eIDAS vs US UETA), and overseas enterprises need to adapt locally; At present, Contract Lock, in conjunction with internationally renowned electronic signature and CA institutions, can provide users with cross-border electronic signing solutions that comply with local laws and regulations.

7.2 Future Development Trends

· Deepening technology integration: Legal AI agents: By 2027, 50% of electronic signature platforms will integrate legal AI agents to achieve full autonomy in contract automatic negotiation, signing, and performance monitoring.

Quantum encryption preparation: Leading enterprises launch research and development of anti quantum cryptographic algorithms to cope with future computing power attack threats.

.· Internationalization and Ecologization: RCEP Paperless Trade Area: With the support of regional mutual recognition policies, the electronic signature interoperability rate in the Asia Pacific region will reach 80% by 2025.

Industrial Internet integration: electronic signature is combined with IoT (logistics electronic lock) and Metauniverse (virtual contract room).

· The wave of inclusiveness:

County government affairs and small and micro merchants have become new growth points. The usage rate of electronic signatures in counties will only be 15% in 2024, and is expected to rise to 40% in 2027. The annual fee for inclusive SaaS tools will be reduced to below 1000 yuan..

8 . Conclusion and Suggestions

8.1 Suggestions for Enterprise Application Paths

· Large enterprises: Prioritize platforms with strong privatization deployment and integration capabilities, such as contract locks, to integrate existing ERP and SCM systems.. Key deployment of smart contracts and blockchain certification.

· Small and medium-sized enterprises: Adopting standardized SaaS packages, focusing on human resources and business cooperation scenarios..

· Overseas enterprises: Choose a platform that supports multi jurisdictional compliance to ensure compliance with local electronic signature laws (such as EU eIDAS)..

8.2 Policy and Manufacturer Development Suggestions

· Policy makers: Accelerate the signing of cross-border mutual recognition agreements and promote pilot projects for electronic signature mutual recognition with RCEP member countries.

· Technology service provider: Building a layered security system: zero knowledge proof to protect privacy+blockchain proof of deposit to prevent tampering+quantum encryption forward-looking layout..

· Explore AI native contract generationState: Implement from“ Signing Tool” To“ Smart Contract Collaboration Platform; The transformation.

Future prospects: Electronic signatures are evolving from digital tools to intelligent business infrastructure. With the deep integration of AI and blockchain technology, a; Signing is collaboration, performance is risk control, and data is asset; The era of smart contracts with distinctive features is coming. It is expected that by 2030, the size of China's electronic signature market will exceed 63.8 billion yuan, of which 80% of the contract process will be driven by AI to complete the entire process of initial review, signing, and archiving, building a truly trustworthy and efficient digital contract network for enterprises.

沪公网安备 31011202012092号

沪公网安备 31011202012092号