The Ministry of Finance and other departments jointly promote the digitization of bank letters and provide intelligent signing support for contract locks

Recently, the Ministry of Finance and the State Administration for Financial Regulation issued the "Notice on Accelerating the Digital Development of Bank Correspondence" (Finance and Accounting [2025] No. 10), promoting the large-scale application of bank correspondence and improving the quality and efficiency of bank correspondence and replies. As early as January 2024, the Ministry of Finance issued the "Notice on Issuing the Operational Guidelines for Bank Correspondence Work", which clearly stated that digital correspondence should have and use reliable digital signatures, that is, valid electronic seals. (Screenshot from the official website of the Ministry of Finance) Contract lock electronic signature has been applied and practiced in the digital business of letter of credit in many commercial banks and rural credit cooperatives, supporting integration with bank letter of credit systems, providing them with secure and tamper proof, trustworthy identity authentication, and convenient online signing services.

It supports the full digitalization of online letter sending, online signing authorization, bank online response, and automatic document archiving, shortening the processing cycle of bank letter of credit business from 10-30 days in the past to within 1 day, and the fastest single response time is only a few hours. .

“ Bank Letter of Confirmation and Reply;

is the process in which an accounting firm, after obtaining authorization from the audited entity, sends an inquiry letter to a banking and financial institution. The banking and financial institution queries and verifies the relevant information received in response to the inquiry letter, and directly provides a written reply.

Why promote the use of electronic correspondence?

Paper correspondence: Drafted by an accounting firm and sent by express delivery to the audited enterprise for offline stamping and return, and then sent by express delivery to the bank for verification and stamping of the reply letter.

· Correspondence is circulated between multiple units, and each link requires manual processing. Express transmission takes several weeks.

· It is easy to encounter phenomena such as incorrect filling of information, missing filling, and misreading. Banks may not be able to match information correctly, and response information may be incorrect.

· There are multiple offline turnover processes and intervention factors, which may not only result in loss or damage, but also lead to data forgery.

· Banks receive a large number of inquiry letters every month, verifying and confirming information, and offline stamping consumes a lot of time and energy.

· We must rely on paper documents, which require printing and express delivery turnover, occupying a large amount of manual resourcesHigh cost.

Electronic letter of credit: Supported by the bank letter of credit system and combined with electronic signatures, it realizes the digitization of the entire process of sending and authorizing replies without the need for manual intervention.

· Confirmation dataAutomatically entered intotemplate, avoiding the hassle of repeated proofreading and document preparation caused by human errors, and making the data more accurate.

· The entire process of sending, authorizing, and responding to letters is automatically recorded, and each node is held accountable to prevent risks such as information interception and tampering.

· The documentis circulated online with real-time progress updates, eliminating the need for excessive effort, saving the trouble of express printing, and improving efficiency.

· All signatoriesintelligently verify their true identities, ensuring the credibility of authorization and response information, and reducing the difficulty of identity verification work.

· Electronic correspondence is encrypted and tamper proof throughout the entire process, and can be verified for authenticity online at any time, effectively preventing fraud and improving audit quality.

The Application of Electronic Signature in Bank Correspondence Work

01

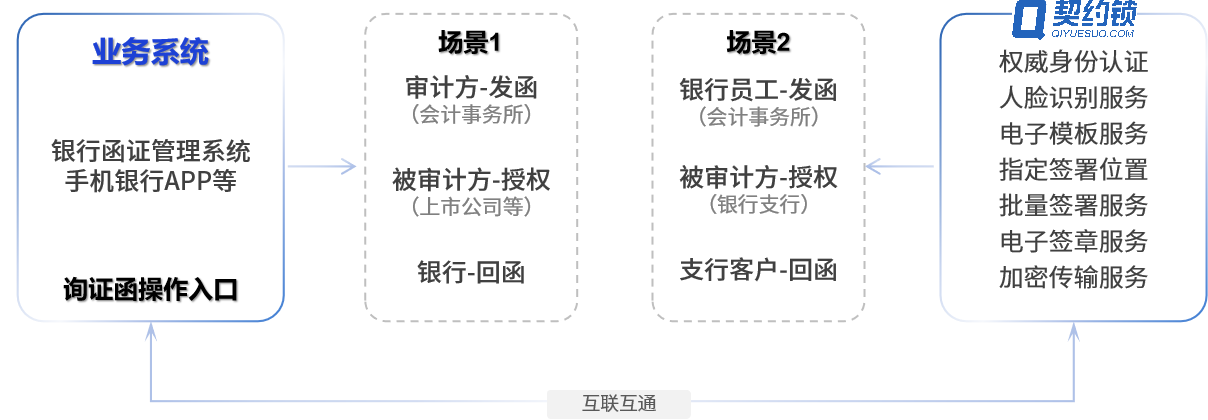

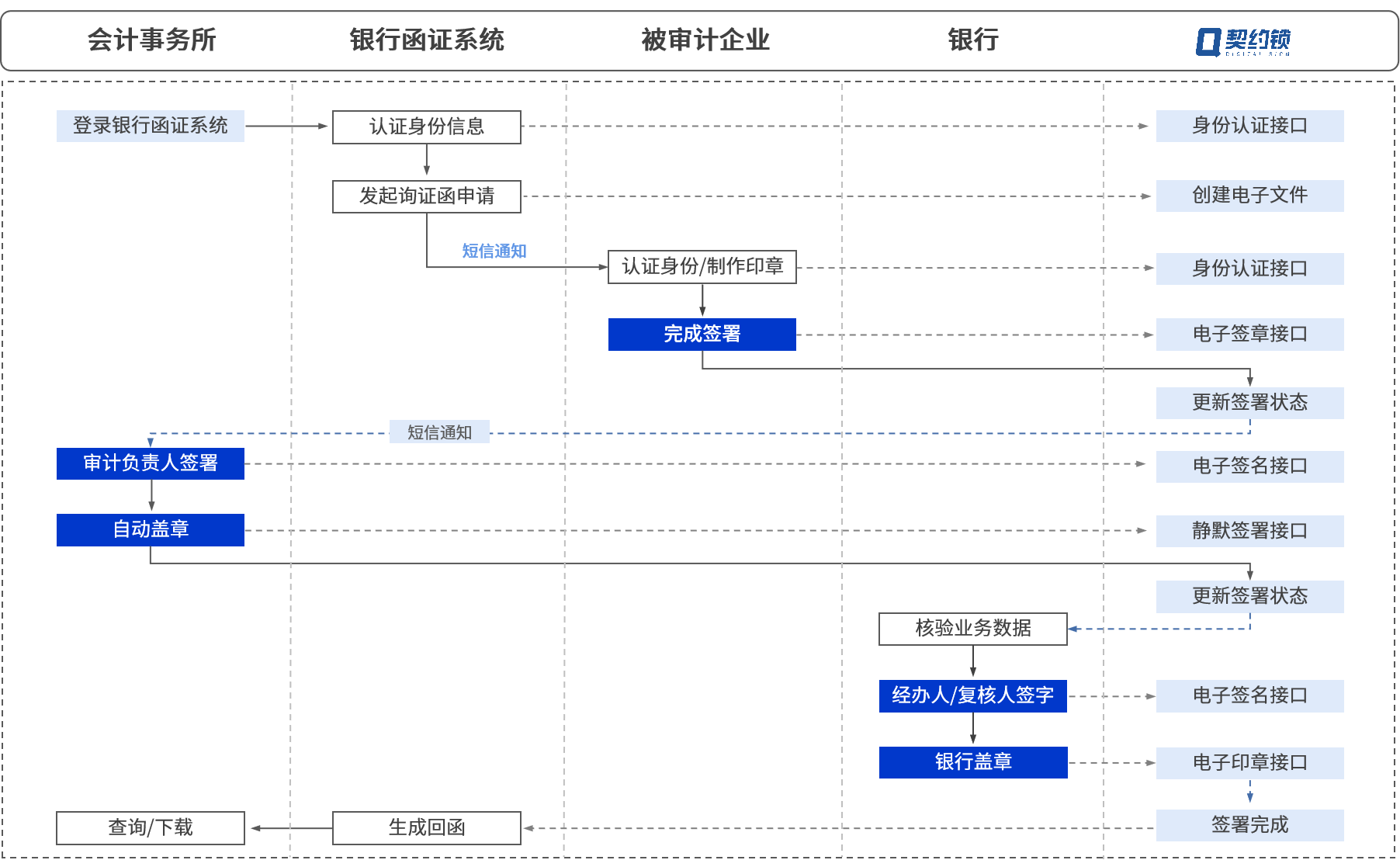

Scenario of electronic signature of audit confirmation letter from external accounting firm

Intelligent online printing for sending, authorizing, and responding letters, automatic data archiving, and full process tamper proof

Integrating electronic signatures into the bank letter system to create a convenient electronic inquiry letter signing platform that covers accounting firms, audited enterprises, and banks. The letter sending process provides intelligent electronic templates, designated signing locations, and other services to quickly configure signing information; Authorization and response letter online verification of real identity, SMS receipt of signed information, real-time verification of data, online signature and seal, signed documents automatically returned to the bank's letter system for archiving, and can be viewed and confirmed at any time. Online circulation and transmission of letters of confirmation, breaking down the information barriers of traditional inquiry letter business, resolving the trouble of offline signing, realizing convenient collaboration and mobile signing among three parties online, and comprehensively improving the efficiency of inquiry letter processing.

02

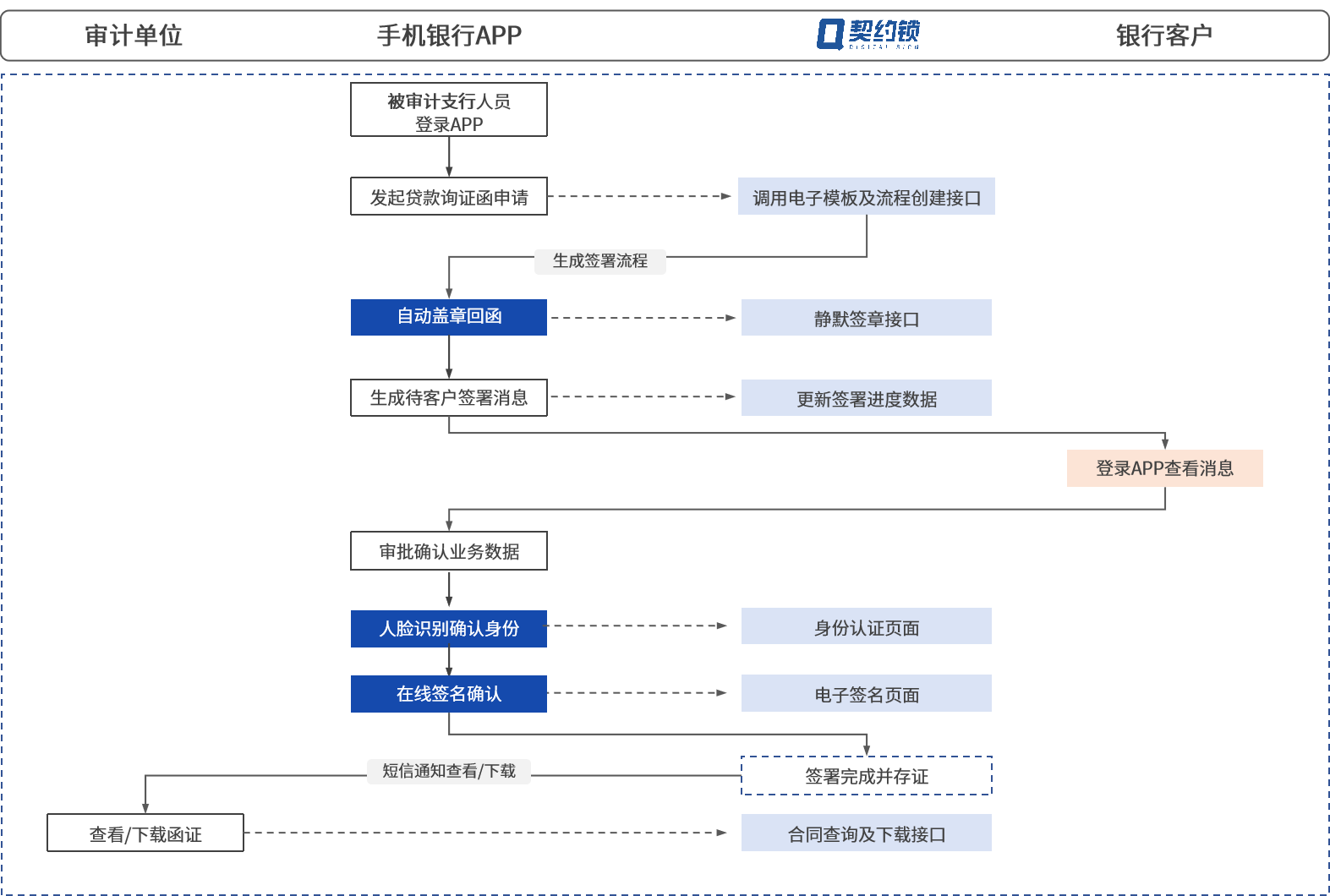

Internal branch business audit confirmation letter electronic signature scenario

Branch online letter sending, customer online reply, automated stamping, fast data audit

Banks often hire accounting firms to audit branch loans and other businesses, and need to send confirmation letters to branch customers to confirm business transaction data

, through

span data style application id="font family a14c4e28" Style="font family: Arial, Helvetica, sans serif;">The application of electronic signature can directly embed electronic signing function in the bank's internal mobile banking app, promoting the comprehensive digitization of internal audit letters and customer replies. · Branch employees can retrieve customer information through the mobile banking app, initiate confirmation letter applications with just one click, and automatically synchronize data to the contract lock platform to complete electronic file and signature approval task creation. · In order to improve internal office efficiency, the bank automatically completes the stamping process and sends letters quickly after internal approval. · The customer can check the electronic confirmation letter and sign the message through the mobile banking APP

message, verify their identity online, sign and submit approval opinions, and complete the reply letter. · After both parties have signed, the electronic files will be automatically returned to the banking system, and the auditing unit can view and verify them online. The audit results are reliable and the procedures are convenient and compliant.

> Multiple intelligent tools to facilitate the convenient application of electronic correspondence:

1) Electronic Template Assisted Intelligent Drafting of Letter of Confirmation: The Contract Lock Electronic Signature Platform's intelligent template service can establish standardized electronic letter of confirmation templates based on the standard letter of confirmation format specified in the "Guidelines for Bank Letter of Confirmation and Reply Work", and apply them to written documents with one click, unifying the letter of confirmation format templates and standardizing the sending and replying of letters.

2)“ Riding Seal” One click coverage of the entire text, efficient response:The contract lock electronic signature platform supports adding a stitch seal with just one click, allowing banks to accurately cover the entire text without manually flipping pages during the response process, improving the efficiency of staff stamping.

3) Support online signature reminder and anti overdue: According to the requirements of bank letter management, audited units and banks must reply within the legal time limit. In order to ensure timeliness, online signature deadlines can be set, with automatic reminders and one click signature reminders for expiration and overdue, without the need for manual contact and promotion, making it more convenient.

4) Intelligent verification of third-party identities: Contract locks work with authoritative CA institutions to provide online authentication and identity verification services for electronic letter of credit applications, ensuring the credibility of the identities of audit units, authorized enterprises, and bank signatories, and guaranteeing the validity of inquiry letters.

5) Encryption transmission and tamper proof service: Using national encryption algorithms (SM2/SM3/SM4) for encryption, ensuring the security of letter data transmission and preventing tampering throughout the entire process.

6) Automatic recording and storage of data for letter signing: The entire process of sending, authorizing, and responding to letters is automatically recorded and verified, with transparent operations at all stages and the ability to track individuals at any time, making business processes more compliant.

7) Electronic Confirmation Online Authenticity Verification Service:Provides electronic evidence verification services, simply upload the electronic confirmation to the system to check the authenticity in seconds, and prevent data fraud.

8) Intelligent matching of special seal for correspondence: According to the requirements of the Ministry of Finance's correspondence management, banks need to strengthen the management of seal for reply letters, clarify the seal for reply letters, and the contract lock can help bind the special seal for reply letters in advance. The bank's stamping process automatically matches the seal information and stamps it to prevent the misuse of seals and incorrect seals. > These banks are all using contract locks:

(Note: The above are some banking customers of contract locks, ranked in no particular order)

Summary

With the promotion of policies by the Ministry of Finance, digital solutions for correspondence with electronic signatures as the core will be implemented in more and more banks.

Contract Lock , as a leading third-party electronic signature service provider in the industry, helps banking organizations integrate correspondence systems with excellent open integration capabilities, expand platform online drafting, approval, and signing capabilities, promote the digitization of correspondence, authorization, and response processes, and accelerate the digitization of electronic correspondence. Scale up application of certification. The digitalization process of bank correspondence

Electronic Signature Application Policy:

· On August 10, 2020, the Ministry of Finance and the China Banking and Insurance Regulatory Commission jointly issued the "Notice on Further Standardizing the Work of Bank Correspondence and Reply Letters" (Finance and Accounting [2020] No. 12), encouraging banks to use "; Electronic seal with anti-counterfeiting function” Reply to the letter.

· On January 28, 2022, the Ministry of Finance, the People's Bank of China, and five other departments jointly issued the "Notice on Carrying out the Pilot Work of Bank Letter Confirmation" (Finance and Accounting [2022] No. 5): For pilot banks that have already implemented electronic reply letters, pilot accounting firms should adopt electronic methods to carry out letter confirmation business. Accounting firms should properly keep electronic replies in accordance with relevant regulations on audit archives.

· On December 30, 2022, the Ministry of Finance and the China Banking Regulatory Commission issued a notice on accelerating the standardization, intensification, and digitization of bank letter of credit (Finance and Accounting [2022] No. 39), encouraging qualified accounting firms and banks to carry out digital letter of credit through bank letter of credit platforms (including third-party letter of credit platforms and self built letter of credit platforms).

· On January 24, 2024, the Ministry of Finance issued a notice on the issuance of operational guidelines for bank letter of credit work, which clearly stated that digital letters of credit should have and use reliable digital signatures, namely effective electronic seals.

· On April 30, 2025, the Ministry of Finance and the Financial Regulatory Headquarters jointly issued a notice on accelerating the digital development of bank letters of credit: to uniformly promote the large-scale application of electronic letters of credit and improve the quality and efficiency of bank letter reception and response.

沪公网安备 31011202012092号

沪公网安备 31011202012092号