Latest progress in electronic signature application in the banking industry: online centralized management of branch seals, 40+business intelligent seals

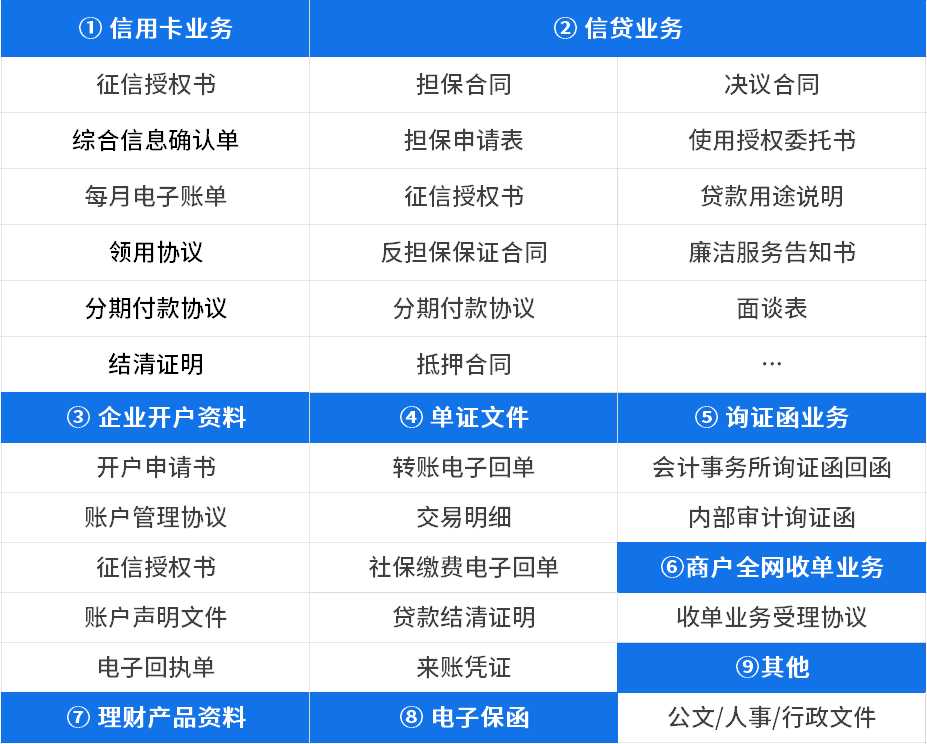

According to statistics, as of now, the banking industry (including various commercial banks, credit cooperatives, policy banks, etc.) has been; Credit card business, credit business, wealth management sales product business, counter business, letter of guarantee business, mobile banking receipt business, enterprise account opening, inquiry letter, online acquiring, etc; Using electronic signatures in over ten core businesses and more than 40 scenarios to improve service efficiency and accelerate the digital transformation of finance. According to data released by the State Administration for Financial Regulation, as of the end of 2024, more than 3800 banking institutions in China have over 200000 branches nationwide. Having multiple institutions, seals, and signing requirements is the norm for bank seal management: · The banking business network is vast, with its first and second tier branches spread across the country, and the problem of difficult remote management of seals for hundreds of branches is prominent. · The offline processing of physical seals has increased the difficulty of expanding out of town customers for various branches, and customer managers often travel around with seals.

· In the process of handling various settlement, deposit and withdrawal, loan, wealth management and other businesses, multiple parties need to affix seals, and information needs to be repeatedly reviewed online and offline, manually entered, and filled out on site. Business processing takes a long time and queues are inevitable during peak periods.

· Each business requires vouchers, documents, or contracts to be signed, and the cost of printing, using paper, and storing in large quantities is high. · There are many businesses and personnel involved, and there are large quantities of business documents output every day. It is difficult to verify whether the use is standardized in a timely manner, and blame will be pursued afterwards. Using electronic signatures to solve the problems of remote seal usage and manual seal management at various bank branches, and to improve service efficiency, has become a standard feature of digital transformation in the banking industry. As a leading brand in the industry, Contract Lock is committed to“ Intelligent printing control+intelligent signing+scene based integration+information and innovation compliance” The four in one capability has become the preferred electronic signature service provider for many banking organizations. Assist in building an intelligent electronic signature and seal control platform for both inside and outside the bank, achieving unified management of seals and intelligent risk prevention and control. Through integration with various internal business systems of the bank, promote online intelligent signing of business documents, contracts, agreements, and other materials, gradually eliminating paper and achieving dual optimization of efficiency and cost.

These banks are all using contract lock electronic signatures (Note: The above are some bank customers of contract lock, and the ranking is not in any particular order.

)

)

Progress in the promotion and application of electronic signatures in the banking industry

I. Progress in the popularization and application of policies:

Since 2019, the People's Bank of China, the CBRC, the Ministry of Finance, the State owned Assets Supervision and Administration Commission, the Financial Supervision and Administration and other departments have issued several documents to promote the deepening application of electronic signatures in the banking industry.

II. Progress in popularization and application of business scenarios:

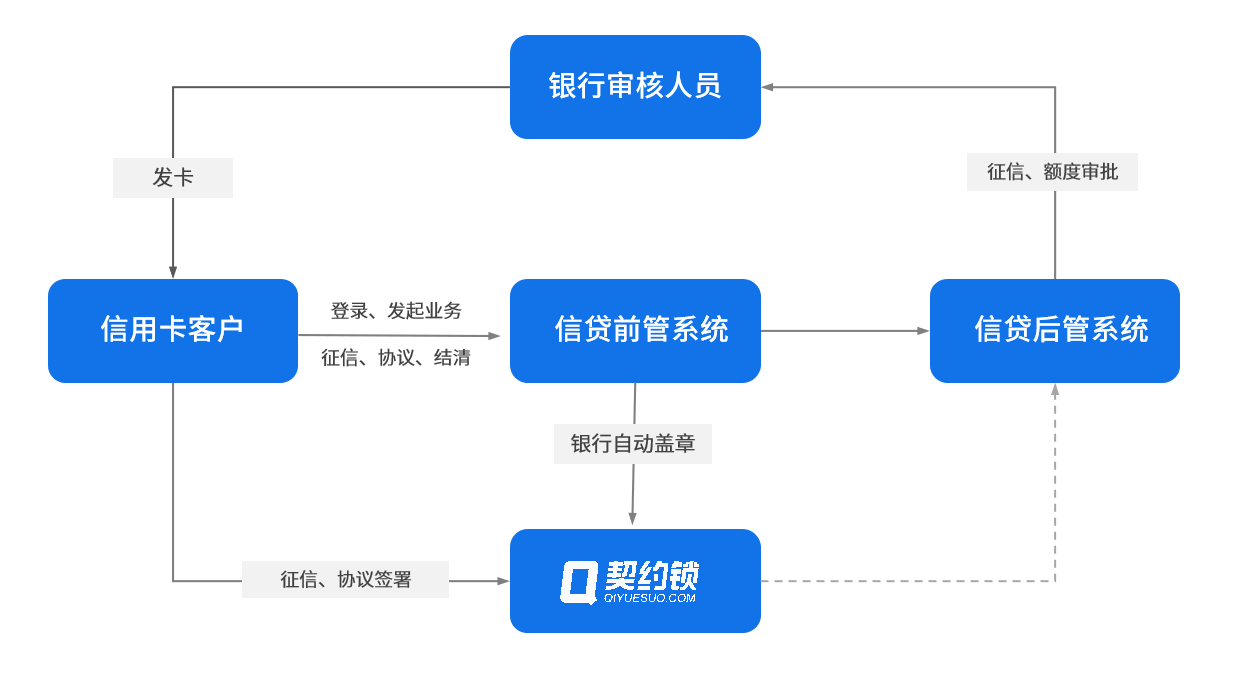

01 Electronic signature for credit card business

Scenario: Credit authorization letter, comprehensive information confirmation form, monthly electronic bill for credit card, collection agreement, installment payment agreement, settlement certificate, etc. After integrating with the credit card system, all key documents from early credit authorization, to application/installment agreement signing, and subsequent voucher issuance are signed online and delivered in real-time. Customers no longer need to repeatedly sign and confirm the authenticity of documents, significantly reducing the average approval time per person.

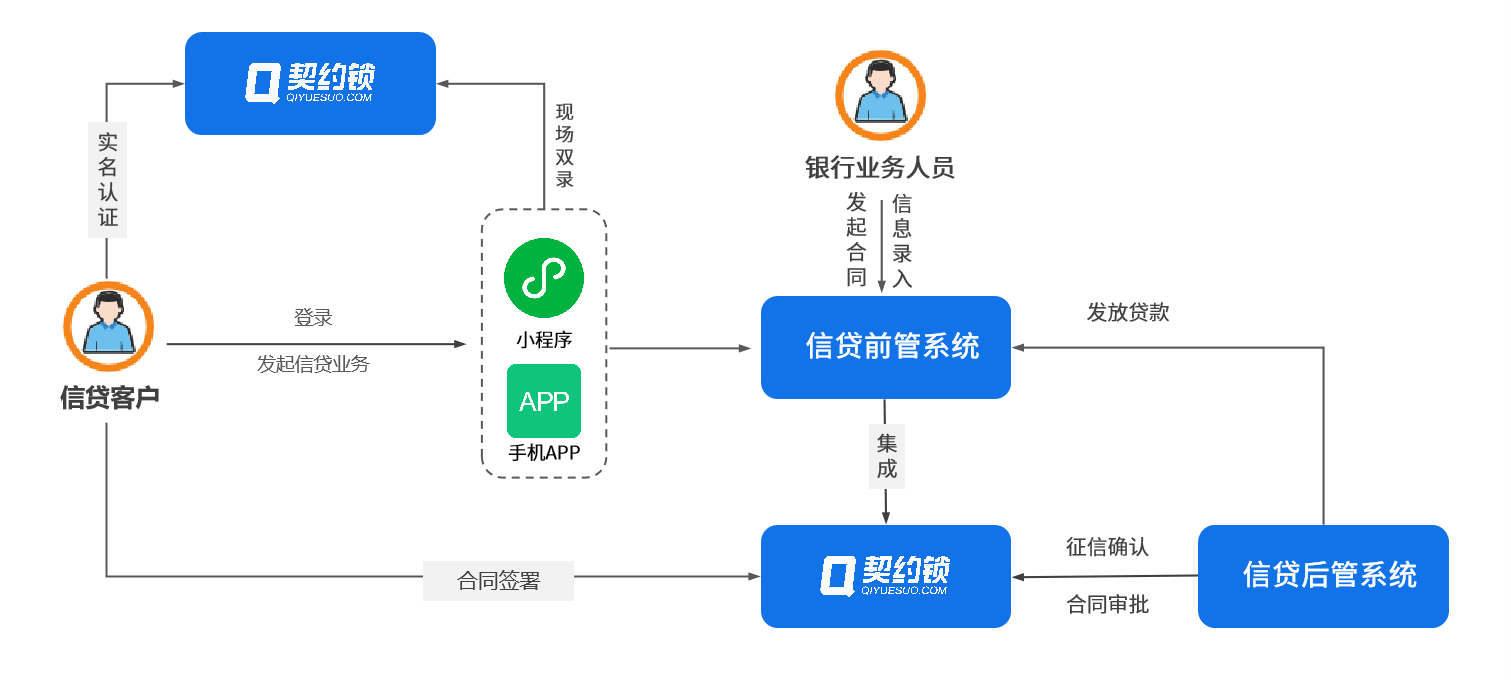

02. Electronic signature for loan business

Scenario:

Required for personal credit loans, car installment loans, and other businesses; Credit Authorization Letter, Guarantee Contract, Counter Guarantee Contract, Installment Payment Agreement, Loan Contract, Mortgage Contract, Guarantee Contract, Resolution Contract, Authorization Letter for Use, Loan Usage Statement, Retail Credit Integrity Service Notice, Interview Form; Waiting for various scenarios. The contract lock supports the integration of bank loan business systems and mobile banking apps, providing a legal and effective online signing window for bank loan business, digitizing the entire process from loan application, credit authorization to guarantee and contract signing. Through the application of

electronic signature

, customers, bank personnel, and guarantee banks can achieve online one-time authentication and batch signing, avoiding customers' repeated trips and complicated sorting of paper materials, improving efficiency and customer loan experience. a href=" https://www.qiyuesuo.

Com/us/blog/288737516431960 "rel=" noopener noreferer "target=" -blank ">Click to view details

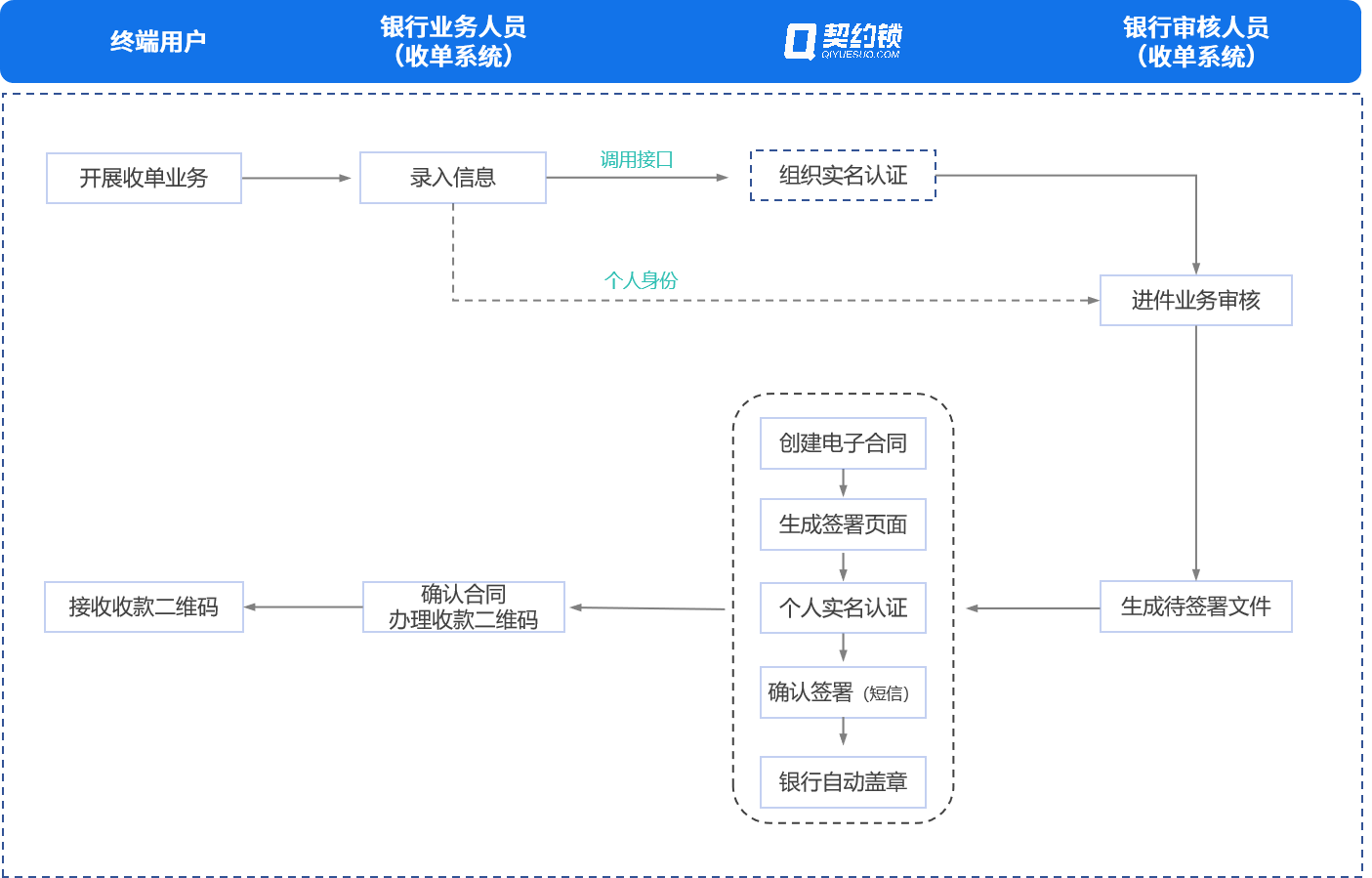

03. Merchant's online acquiring business electronic signature

Scenario: Acquiring business acceptance agreement

Bank's online acquiring business usually refers to the bank providing domestic and foreign currency fund settlement services to contracted merchants through its system. Merchants need to submit a processing application to the bank, complete the agreement signing, complete the collection code processing, and open the online acquiring business. The contract lock supports access to the bank's acquiring business system, QR code activation application processing, and supports online self-service signing by individuals/merchants. The system automatically generates legal documents stamped with valid seals, saving a lot of express delivery and verification time, and increasing the efficiency of small and micro merchants' contract processing by more than twice.

04. Electronic Letter of Guarantee Business Electronic signature

Bank guarantee refers to a written credit guarantee certificate issued by a bank to a third party at the request of the applicant. Generally, in loans, payment of bid security by guarantee, or other corporate services, companies often need to apply to banks to issue guarantees and deliver them to third parties as proof. Seamless integration of contract lock into the banking system, customers only need to submit applications and materials online; Automatically generate electronic letter of guarantee process, the bank president can approve and electronically sign at any time on their mobile phone. The process goes directly to the seal user for centralized processing, generating legally effective electronic guarantee documents with just one click, compressing the original 2-3 month processing cycle to the fastest possible completion on the same day. Truly achieving; Run at most once;!

Click to view details

05. Electronic receipt business electronic signature

Scenario:

6. Electronic signature for wealth management product business

Electronic signature is automatically embedded in the process of purchasing, redeeming, canceling and signing agreements for wealth management products. Combining“ Double recording; To meet compliance requirements, ensure that the transaction process is legal and compliant, with complete and traceable records, and provide customers with a safe and convenient online investment experience. 7. Electronic signature for counter business

When handling business at the counter, there is always a pile of paper documents that customers need to manually fill in information and sign one by one, while the teller has to constantly enter data, print, review, copy, stamp, and bind materials. The process is cumbersome, and if any link goes wrong, they have to start over again. The contract lock integrates with the counter business software of the business hall, providing on-site facial recognition authentication, electronic form filling, and electronic signature confirmation services for residents or enterprises who come to handle affairs with the help of mobile devices such as counter tablets. All kinds of paper vouchers and materials generated by counter services can be digitized through the application of electronic signatures, eliminating the hassle of manual filling, printing, and stamping, comprehensively improving customer service experience, and reducing the burden on business halls.

Click to view details

8. Electronic signature for inquiry letter business Common scenarios:

Reply to inquiry letter from external accounting firm; Internal branch business audit confirmation letter. The contract lock integrates with the bank letter of credit system, providing secure and tamper proof, trusted identity authentication, and convenient online signing capabilities to ensure the security of the system; Online letter sending, electronic authorization, automated response, and intelligent document archiving; Efficient operation throughout the entire process. The traditional 10-30 day letter confirmation cycle has been significantly shortened to within 1 day

, with a single reply taking only a few hours at the fastest.

· Accounting firm inquiry letter reply: External accounting practice firms can quickly send letters online through established processes and templates. After the audited enterprise signs and authorizes the letter online, the bank will stamp the reply online without the need for paper or automatic circulation. · Branch business audit inquiry letter: The bank's internal audit directly issues inquiry letters to branch customers online, and the mobile phone can quickly verify their real name, confirm business data, and sign online to complete the reply.

Click to view details 9. Electronic signature of enterprise account opening information

Scenario: Account opening application form, account management agreement, credit authorization letter, account declaration document, electronic voucher, electronic receipt, etc. Opening a corporate bank account is a necessary process for starting a business, as well as the foundation for maintaining operations and conducting financial transactions. Only after opening an account can the enterprise register for taxation and handle social security. Contract lock helps integrate local government self built“ Electronic License System; Implement real name authentication for newly established enterprises and apply for electronic seals online; Simultaneously with“ Banking Business Approval System; Connect and provide online account opening services for enterprises; Identity authentication, electronic signing; Service.

Sign the account opening materials online to ensure your real identity. Apply for and sign the account opening materials online, eliminating the hassle of manually filling out forms and running errands. You can remotely open an account in as little as half an hour. Click to view details

Other

Scenario:Internal documents, personnel contracts, and certificates required for the daily operation and management of the bank

=“ https://www.qiyuesuo.com/?source=12&keyword=gw -Yhdzq250806 "rel=" noopener noreferrer "target=" -blank ">Electronic signaturescan be embedded into the internal OA office system to quickly enable contract locks in the signing and stamping process, achieve internal stamping, digitize employee signatures, and improve management efficiency.11. Solve the problem of seal control in branches and outlets

Scenario:Hundreds of institutional outlets have unified seal management, intelligent warning and blocking of seal risks, and dynamic real-time notification of seals, helping banks implement seal management systems.

In addition to providingElectronic signatureservice, contract lock can also help banks create a unified digital seal control platform, solve problems such as difficult management of seals in branches and hundreds of branches, integrate AI intelligent technology tools to help banks intelligently monitor, warn, and block seal risks, intelligently review the implementation of seal management system, and intelligently control a set of thousands of seals to improve the quality of seal bank management.

The application of electronic signatures accurately hits the core demands of banks in seal risk control, business efficiency improvement, compliance audit protection, and customer experience optimization. By deeply integrating into all business scenarios such as credit cards, credit, acquiring, guarantees, and wealth management, electronic signatures not only achieve; Risk mitigation and efficiency improvement; The operational goals of the bank have reshaped the core of its digital competitiveness with secure, convenient, and trustworthy online services, helping to promote the high-quality development of bank services.

The service advantages of Contract Lock in the banking industry:

As a leading electronic signature and intelligent electronic contract service provider in the industry, Contract Lock has not been involved in any customer litigation disputes since its establishment, and has service experience in multiple large and medium-sized organizations. According to the Frost Sullivan report, the localization deployment of Contract Lock ranks first in the industry.can provide secure, compliant, and convenient electronic signature services to banking customers at any time.

· Product implementation for full stack adaptation of Xinchuang: Contract lock products are compatible with operating systems CPU、 Various software and hardware products such as databases, browsers, and middleware have achieved full stack adaptation for information and innovation, which can meet the requirements of the localization construction of electronic signatures for central state-owned enterprises.

· Product qualifications are complete, compliant and safe: The contract lock product is designed strictly in accordance with the requirements of the Electronic Signature Law and has the capability to; Commercial Password Product Certification Certificate CMMI3、 Level 3 security protection and ISO27001 information security management system certification; By obtaining numerous authoritative certificates, we can provide government agencies with compliant, secure, and trustworthy electronic signature and seal control services.

· Multiple product options and flexible usage: The contract lock electronic signature product supports multiple deployment methods such as public cloud and private cloud, and can provide diversified services such as UKey signature, mobile signature, intelligent electronic contract, seal control, identity authentication, and digital archiving, helping central state-owned enterprises establish a trusted digital foundation.

· Excellent integration capability:It can be integrated with various management software as needed, helping to create intelligent electronic signature scenarios that meet the needs of central state-owned enterprises for document and office handling.

· Intelligent service capability:Integrating AI intelligent technology, supporting intelligent drafting of documents, intelligent legal review, intelligent compliance review, intelligent text comparison and other intelligent services, innovating and promoting efficiency improvement.

· Rich in features and customizable on demand:can provide“ for banks as well; Audio and video dual recording authentication; 、 “ Intelligent drafting; 、 “ Reading time limit before signing; 、 “ Batch signing; Various unique signing functions that meet industry needs can be customized at any time to make signing more convenient.

沪公网安备 31011202012092号

沪公网安备 31011202012092号